What you’ll learn

-

Learn the fundamentals of derivatives at a quantitative level

-

Master arbitrage, the core principle underlying derivatives, quantitative risk management and quantitative trading

-

Use derivatives to control and manage financial risk

-

Price forwards, futures, swaps and options

-

Understand the Black-Scholes theory and formula intuitively, avoiding stochastic calculus

-

Learn the limitations of the Black-Scholes theory, and how it is used in practice

-

Python based tools are provided for computations with bonds, yield curves, and options

Here is a sampling of some of the main topics that we’ll cover on your journey into the quant profession:

- Interest rate fundamentals

- Periodic and continuous compounding

- Discounted cash flow analysis

- Bond analysis

- The fundamentals of equity, currency, and commodity assets

- Portfolio modelling

- Long and short positions

- The principle of arbitrage

- The Law of One Price

- Forwards, futures, and swaps

- Risk management principles

- Futures hedging

- Stochastic processes

- Time series concepts

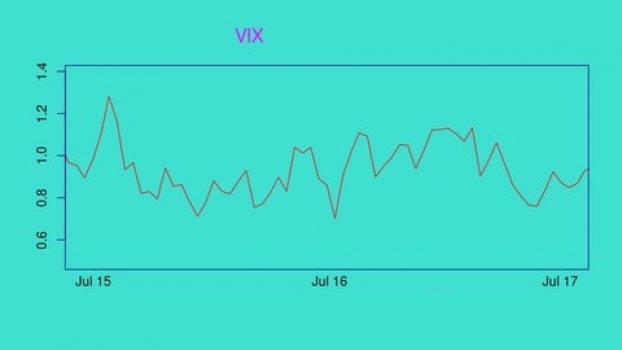

- The real statistics of asset prices: volatility clustering and autocorrelation

- Fat-tailed distribution and their importance for financial assets

- Brownian motion

- The log-normal model of asset prices

- Options

- Put-call parity

- The binomial model of option pricing

- The Black-Scholes theory and formula

- Option greeks: delta, gamma, and vega

- Dynamic hedging

- Volatility trading

- Implied volatility

Includes Python tools

Python based tools are now included for computations with bonds, yield curves, and options. All software that is part of this course is released under a permissive MIT license, so students are free to take these tools with them and use them in their future careers, include them in their own projects, whether open source or proprietary, anything you want!

So Sign Up Now!

Accelerate your finance career by taking this course, and advancing into quantitative finance. With 23 hours of lectures and supplemental course materials including 10 problem sets and solutions, the course content is equivalent to a full semester college course, available for a fraction of that price, not to mention a 30 day money back guarantee. You can’t go wrong!

Who this course is for:

- Technical professionals who want to learn about quantitative finance

- Finance professionals who want to improve their quantitative skills and learn how to analyze derivative products

Can I download Financial Derivatives: A Quantitative Finance View course?

You can download videos for offline viewing in the Android/iOS app. When course instructors enable the downloading feature for lectures of the course, then it can be downloaded for offline viewing on a desktop.Can I get a certificate after completing the course?

Yes, upon successful completion of the course, learners will get the course e-Certification from the course provider. The Financial Derivatives: A Quantitative Finance View course certification is a proof that you completed and passed the course. You can download it, attach it to your resume, share it through social media.Are there any other coupons available for this course?

You can check out for more Udemy coupons @ www.coursecouponclub.comDisclosure: This post may contain affiliate links and we may get small commission if you make a purchase. Read more about Affiliate disclosure here.